Renters Insurance in and around Chicago Heights

Your renters insurance search is over, Chicago Heights

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Calling All Chicago Heights Renters!

Home is home even if you are leasing it. And whether it's an apartment or a house, protection for your personal belongings is good to have, even if you think you could afford to replace lost or damaged possessions.

Your renters insurance search is over, Chicago Heights

Renters insurance can help protect your belongings

Safeguard Your Personal Assets

Renters rarely realize how much money they have tied up in their possessions. Just because you are renting a apartment or property, you still own plenty of property and personal items—such as a a piece of family jewelry, guitar, bed, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why purchase your renters insurance from Harvey Adams? You need an agent who wants to help you evaluate your risks and examine your needs. With dedication and efficiency, Harvey Adams is here to help you keep life going right.

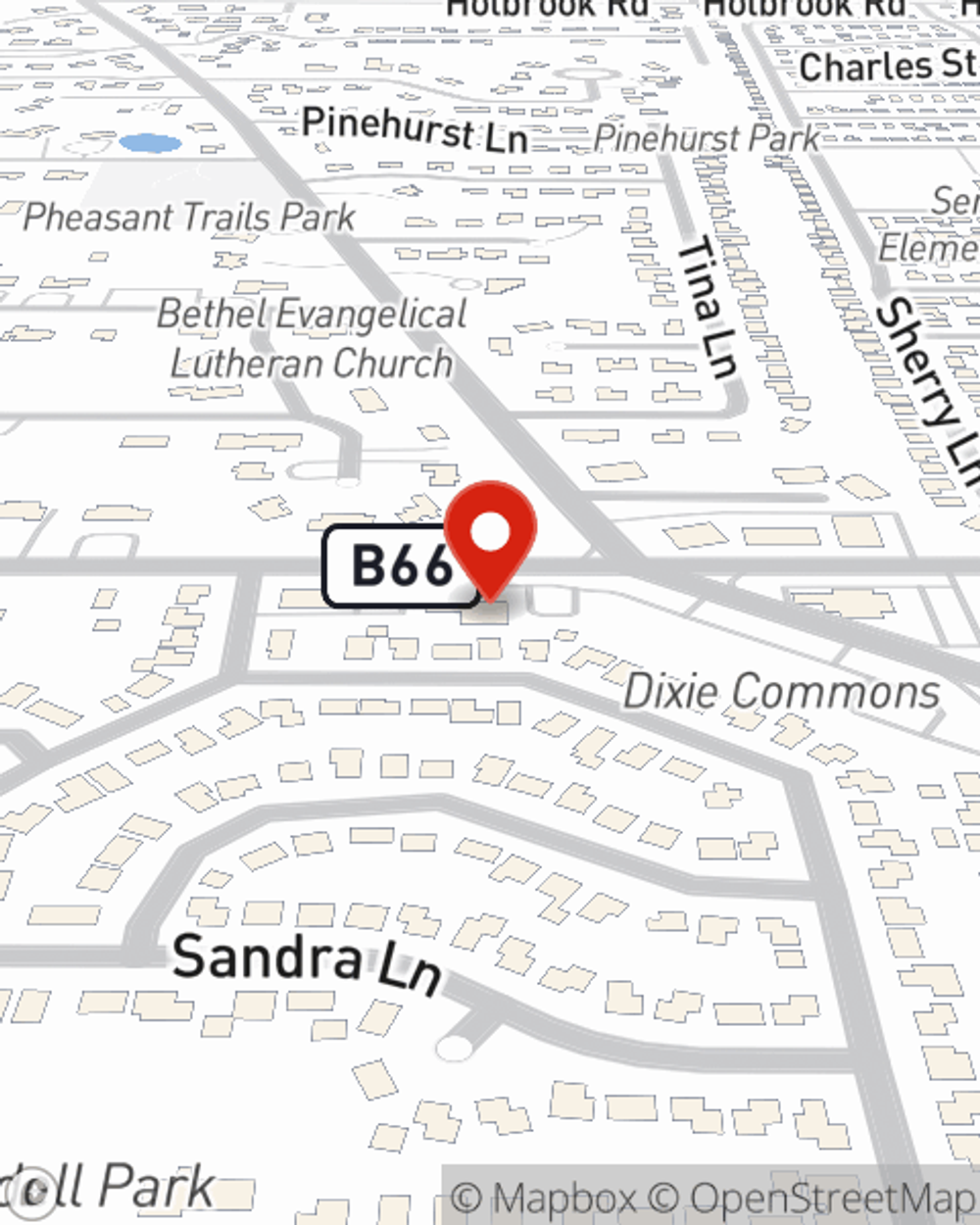

Visit Harvey Adams's office to learn more about how you can benefit from State Farm's renters insurance to help keep your belongings protected.

Have More Questions About Renters Insurance?

Call Harvey at (708) 755-9627 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Harvey Adams

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.